Preserving Wealth: Adopting a structure to meet relocation needs

Client profile: A Brazilian HNWI looking to relocate to another jurisdiction

Challenges: Optimizing fiscal impact in the jurisdiction of the underlying companies and current tax domicile of the client, and preserving wealth to accommodate future needs of the family

Vistra services provided: Setting up of Trusts, comprehensive review of corporate structure, corporate secretarial services

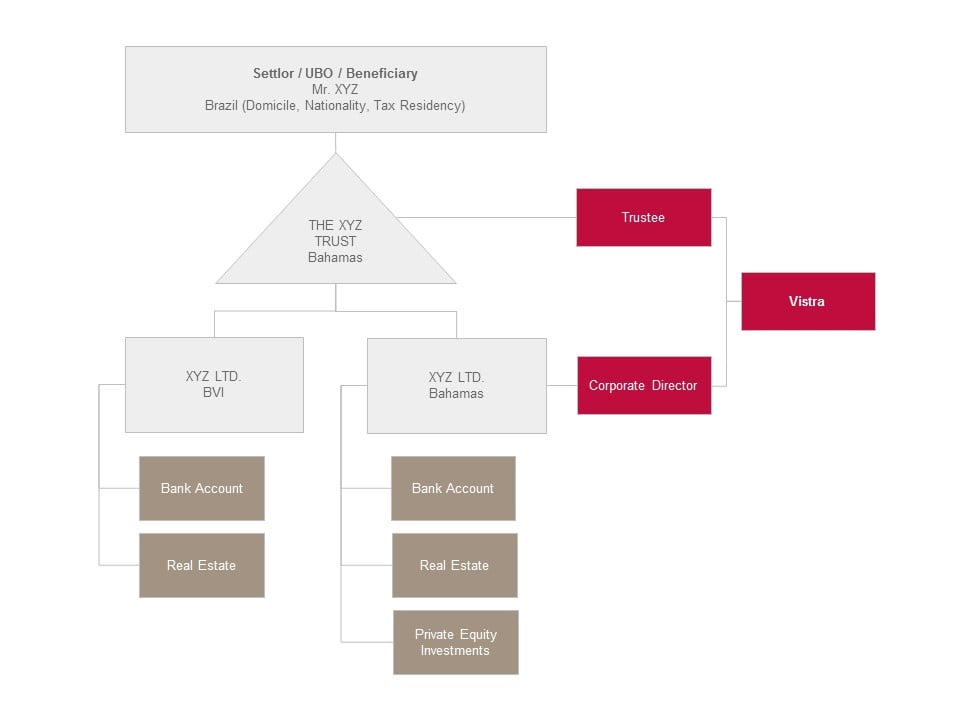

A long-standing private wealth client of Vistra was planning his relocation from Brazil to another jurisdiction and engaged Vistra for a comprehensive “health check” of his corporate structure.

The client’s structure was composed of corporate vehicles in various jurisdictions, which hold financial investments, equity participations and real estate. The client’s intention was to simplify the structure, implement a succession planning solution and make the necessary adjustments to preserve wealth and accommodate the future needs of all the family members.

A tailor-made plan was developed by Vistra’s dedicated Brazil desk in Zurich, considering legal and tax implications in each jurisdiction and involving local advisors. Once all needed actions were defined, the corporate secretarial work was kicked-off. With our expertise and global network, Vistra was able to implement the changes in the structure in a timely manner and provided the client with a peace of mind by approaching the relocation in a well-prepared and organized manner.

In order to fulfil our client’s requests, the Vistra team approached the case in several aspects, including: optimizing the fiscal impact in the jurisdiction of the underlying companies as well as the current tax domicile of the client, adjusting corporate documents, coordinating with legal and tax advisors, notaries, beneficiaries and the client, and finally settling a Trust to facilitate transmission of assets to future generation in a smooth manner.

As a result of the unique service solutions provided by Vistra and a pleasant experience, a close family member of the client in a similar situation is keen to replicate the solution and has recently engaged Vistra for the services. There is no greater advocacy than an existing client’s referral to their family members, close connections and business associates. This is also a testimony to the exceptional client service and professional execution of the succession planning solutions that we at Vistra provides.

If you would like to discuss how Vistra can help you create, preserve or transfer your wealth, please contact one of your local experts:

| Location | Name and title | Phone number |

|---|---|---|

| UK | Chris Marquis Global Head of Private Wealth |

+44 203 872 7325 |

| China | Sherrie Dai Managing Director, North Asia |

+86 21 6085 6188 |

| Hong Kong SAR | Yumei Zhang Executive Director, Head of Private Wealth, Greater China |

+852 2848 7580 |

| India | Navita Yadav Managing Director, India & Mauritius |

+91 22 2659 3882 |

| India | Neeraj Aggarwal Director, Private Wealth, India |

+91 22 2659 3659 |

| United Arab Emirates | Heba Al Emara Managing Director, Middle East |

+971 4 278 3600 |

| Singapore | Chris Burton Managing Director, South East Asia |

+65 6854 8010 |

| Singapore | Christine Tan Managing Director, South East Asia |

+65 6854 8061 |

| Jersey | Clive Wright Managing Director, Jersey |

+44 1534 504560 |

| Malta | Dr. Anthony Galea Managing Director, Marine & Aviation |

+356 2258 6400 |

| Switzerland | Sascha Züger Managing Director, Switzerland |

+41 44 296 68 70 |

| UK | David Rudge Managing Director, Corporate & Private Wealth UK |

+44 203 872 7334 |

| UK | Julius Bozzino Director, Private Wealth, International |

+44 203 872 7384 |

| Cyprus | Nick Terry Managing Director, Cyprus |

+357 25 817 411 |

| Luxembourg | Joost Knabben Commercial Director, Luxembourg |

+352 422 229 530 |

| Luxembourg | Farabi Zakaria Commercial Director, Luxembourg |

+352 422 229 398 |

| USA | Raúl Markos Director, Private Wealth |

+1 305 978 1742 |

The contents of this article are intended for informational purposes only. The article should not be relied on as legal or other professional advice. Neither Vistra Group Holding S.A. nor any of its group companies, subsidiaries or affiliates accept responsibility for any loss occasioned by actions taken or refrained from as a result of reading or otherwise consuming this article. For details, read our Legal and Regulatory notice at: https://www.vistra.com/notices . Copyright © 2024 by Vistra Group Holdings SA. All Rights Reserved.